Services in Malaysia fall under provisions. But the supply of both goods and services will be eligible to claim Input Tax Credit ITC in.

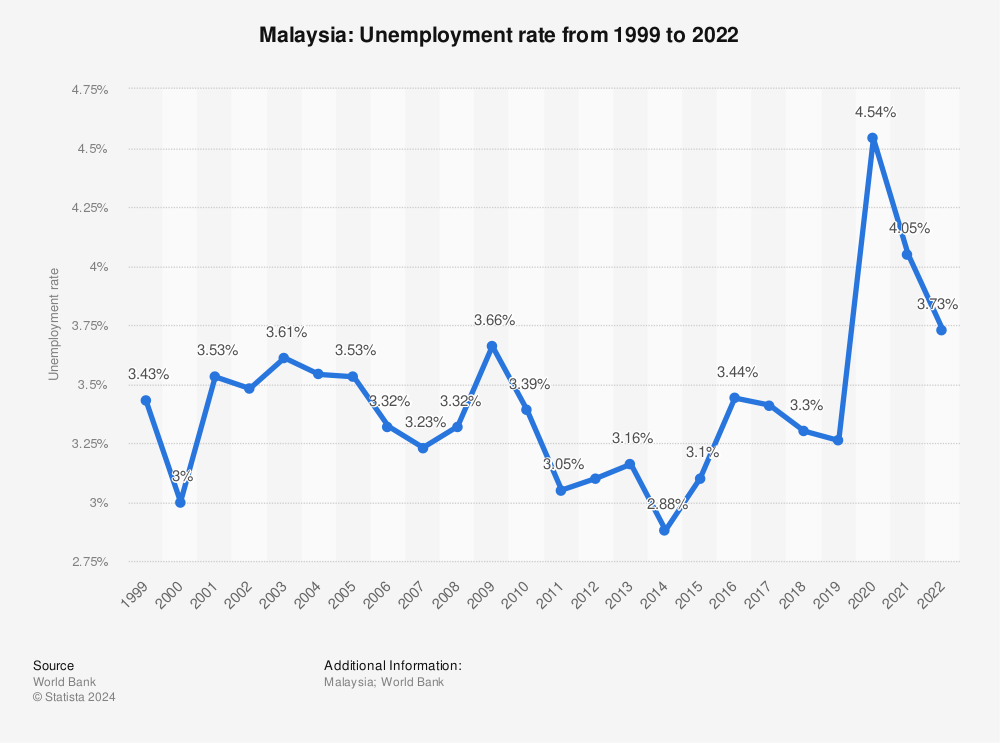

Malaysia Unemployment Rate 1999 2020 Statista

In economics zero-rated supply refers to the list of the items subject to a 0 percent VAT tax on the items input supplies.

. How GST works on a zero rated supply. Cereals and many more. Consequently input tax may be.

The reason why zero-rated supplies are included under the taxable supplies bracket is. The registered person making zero rated supply can claim refund under either of the following options in accordance with the provisions of section 54 of CGST Act. How GST is charged at each level of supply.

Some of the examples of NIL rated supplies are-Salt. 2 2017 Malaysian Debt Ventures EPF Senarai Perjawatan 2018. May 15 2021 Zero Rated Sales 1 - View presentation slides online.

In Malaysia GST largely falls under 4 different categories. In countries that use a value-added tax VAT zero-rated goods are products on which VAT is not levied. GST shall be levied and charged on the taxable supply of goods and services.

Generally all exports of goods and services in UAE will. Supplies with payment of IGST claim refund of IGST paid. Zero-Rated Supply means goods and services sold by the companies are free from Goods and Services Tax GST.

These are taxable supplies that are subject to a zero rate. Zero-Rated Supply is the GST free goods and services provided by the companies. In Malaysia she sales tax charged at 10 is the default sales tax rate.

If their input tax is bigger than their output tax they can recover back the difference. Even though the persons who are running the businesses. After spending the last several hours and night reading through the GST Act talking to tax accountants GST experts and scouring.

Zero-rated supplies in UAE VAT refers to the taxable supply on which VAT is charged at zero rate. Typically the Zero-Rated ZR code is reserved for zero-rated supplies such as beef rice sugar water and electricity. Normally zero rated supplies GST labelled with a Z.

For example if a Singapore company organises a golfing event in Malaysia zero-rating would apply on the basis that the. Input tax credits still take into consideration zero-rated supplies and companies can still claim input tax when purchasing them. As zero-rated supplies are taxable in nature input tax can be recovered.

Here tax is charged at zero-rate either based on the nature of supply regardless of the goods or services supplied or the specified goods or services which are listed under zero-rated list. Examples of goods that may be zero-rated include many types of foods and. Zero-rated supplies refer to the taxable supply on which VAT is charged at a zero rate.

The Goods and Services Tax GST is an abolished value-added tax in Malaysia. Analysis of Time of Supply of Goods and Services under GST Zero Rated Supply. Even if the businesses under the list of Zero-Rated Supply with annual sales not more than 5 lakh they can register with Customs to claim the GST paid.

The examples of zero rated supplies are goods such as basic food and utilities such as beef rice sugar water for domestic use and first 200 units of electricity per months for domestic use. Supply or import of precious metals. GST is collected by the businesses and paid to the government.

Exempt supplies are referring to goods and services which are not subject. Like in Nil rated supply the rate of tax will be 0 in case of Zero rate supply also. Computation of GST on zero rated supply.

However for the above illustration other inputs are ignored. In the example above the supply by the wholesaler is a zero-rated supply. The final price that the consumer has to pay is RM125.

As the name suggests VAT will be charged at 0 on certain notified supplies. Business owners in Malaysia. Download form and document related to RMCD.

Goods and Services Tax Zero Rated Supplies Order 2014 PERINTAH CUKAI BARANG DAN PERKHIDMATAN PEMBEKALAN BERKADAR SIFAR PINDAAN 2017 PERINTAH CUKAI BARANG DAN PERKHIDMATAN PEMBEKALAN BERKADAR SIFAR PINDAAN NO. No GST will be charged on these goods services. They can recover credit back on their inputs.

While the applicable rate of tax is zero for zero-rated supplies they are nonetheless taxable supplies. These are taxable supplies that are subject to a zero rate. Businesses are eligible to claim input tax credit in acquiring these supplies and charge GST at zero rate to the consumer.

How GST works on a zero rated supply at the wholesale level. No GST is collected by the wholesaler on his sales to the consumer but he is entitled to claim all the GST inputs on overheads machinery and packaging. Zero-Rated Supplies Zero-rated supplies are supplies that are considered to be taxable but at a rate of 0 and not 5.

These are standard-rated supplies exempt supplies zero-rated supplies and supplies that are beyond the scope of Goods Services Tax. Guess you must be wondering why the definition says taxable while the rate is at 0 per cent. Some Common Examples Goods and services for business purposes purchased from VAT-registered suppliers.

It is important to analyze whether the goods have physically entered the UAE or not. Standard-rated supplies are goods and services that are charged GST with a standard rate. As exempt supplies are not taxable there is no input tax recovery.

Goods services that fall under each of these categories are pre-determined by the RCDM Royal Custom Department of Malaysia. GST shall be levied and charged on the taxable supply of goods and services. In most cases.

Supplies without payment of IGST under BondLetter of Undertaking such as claim refund of un-utilized input tax credit. Businesses are eligible to claim input tax credit in acquiring. Zero-rated The main difference between zero-rated and exempted goods is that the zero-rated are taxable supplies taxed at the SST 0 rate whereas exempted goods are non-taxable and not subject to SST.

When the company business pays GST on the assets purchases or business expenses they can also claim ITC on this. GST is levied on most transactions in the production process but is refunded with exception of Blocked Input Tax to all parties in the chain of production other than the final consumer. Export of goods and services to non- GCC states.

The existing standard rate for GST effective from 1 April 2015 is 6. Singapore are international services for zero-rating purposes. Zero-rated supplies which can be either goods or services are supplies to which a VAT or GST rate of 0 applies meaning that buyers do not pay any VAT on them.

The term zero-rated supply applies to the list of items that would be taxed under the category of value-added systems and services tax. For company and business GST paid on the assets purchases or expenses for their businesses can be claimed as Input Tax Credit. This allows them to deduct input tax from the VAT.

For example a company purchased goods from its supplier in China and sold the same goods to its customer in Germany. The Standard-Rated SR code is for.

Suunto Ambit3 Peakambit3 Peak Black Suunto Watch Suunto Gps Watch

Decomposition Infogrpahic Ecofriendly Green Environment Savetheplanet Sustainable Greenliving Green Recycling Environmental Awareness Save Environment

Real Property Gains Tax Part 1 Acca Global

Malaysia Poverty Rate By State Statista

Ezee Centrix Hotel Channel Manager Hotel Management Management Menu Card Design

Malaysia Has The World S Highest Deforestation Rate Reveals Google Forest Map

Malaysia S New Energy Transition Plan Lower Renewable Capacity Addition And A Phase Out Of Coal Leads To A Sizeable Increase In Gas Requirements And Affordability Concern Ihs Markit

Meet Aspiration Zero The Credit Card That Rewards You For Going Carbon Neutral Fight Climate Change With Every Credit Card Swipe Go Aspire Cards Credit Card

Everything You Need To Know About Running Payroll In Malaysia

No Claim Discount Ncd The Complete Guide For Malaysia Car Owners

Tax Implications Of Financial Arrangements For Motor Vehicles Acca Global

Lean Six Sigma Malaysia What Are The Methods Involved In The Six Sigma Methodology Lean Six Sigma Leadership Strengths Project Management Professional

Malaysia Has The World S Highest Deforestation Rate Reveals Google Forest Map

Malaysia Has The World S Highest Deforestation Rate Reveals Google Forest Map

The Countries Winning The Recycling Race Infographic Developed Nation Recycling Recycling Facts

Best High Interest Savings Account In Malaysia 2022

Truck Driver Contract Agreement Free Printable Documents Contract Agreement Letter Sample Agreement

Malaysia Sst Sales And Service Tax A Complete Guide

Malaysia Has The World S Highest Deforestation Rate Reveals Google Forest Map